How do i e file a short year 1065 partnership return using interview?

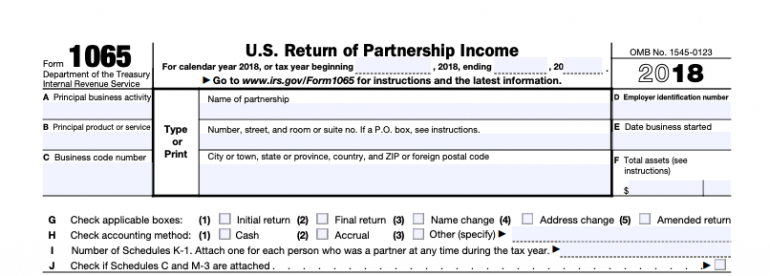

But, the business must still provide a Schedule K-1 to all applicable individuals no later than March 15. Businesses may file a six-month extension for filing the 1065 tax form using Form 7004. Without Forms 1065 or 1120S, individuals cannot receive Schedule K-1. Well, Forms 10S are due by March 15 each year. Instructions for Form 1065 (Schedule B-2), Election Out of Partnership Level Tax Treatment Additional Information for Schedule M-3 Filers Information on Certain Shareholders of an S Corporation Specifically Attributable Taxes and Income (Section 999 (c) (2)) When are form 10s due? Who needs to file Schedule K? Again, Schedule K-1 typically pairs with Form 1120S or IRS Form 1065. Return of Partnership Income, is an IRS tax form that partnerships (or LLCs filing as partnerships) use to report their business’s annual financial information. › Kaspersky Internet Security Promo Codeįrequently Asked Questions What is a 1065 tax form used for?įorm 1065, U.S.

› Social Security Administration Log In Page.Note that if you have absolutely no accounting or income tax preparation experience with respect to entities, you might want to seek professional guidance. Further, TurboTax Business is not available as an online product it must be installed and run in a Windows environment (there is no Mac version). TurboTax Business cannot be used to prepare your individual income tax return so you will need a personal income tax preparation product. Otherwise, the LLC will have to file a Form 1065 and the TurboTax product that is capable of preparing a 1065 is TurboTax Business (link below). If that is the case, you can use TurboTax Self-Employed through the TurboTax web site (i.e., you can prepare your return online). If you and your wife hold your interests in the LLC as community property in a community property state, then you can treat the LLC as a disregarded entity and each of you can file a Schedule C (Form 1040) according to your interests in the LLC.

0 kommentar(er)

0 kommentar(er)